Staying ahead in today’s fast-paced digital world requires a certain advantage. Businesses are constantly searching for methods to expand their reach and efficiency, embracing cryptocurrency as a payment method can open up a realm of possibilities, from tapping into a global customer base to enhancing transaction security. Let’s dive into how the adoption of this technology can be a game-changer for businesses aiming to stay competitive and future-proof their operations.

Riding the Crypto Wave

Imaging diving into a market brimming with untapped potential. The evolution of cryptocurrencies has made it available for everyone, and not just the tech-savvy. This marks a significant move towards a financial ecosystem that is more inclusive and decentralised, evidenced by the surprising uptick in cryptocurrency ownership. Key survey findings from the Security Organisation show that more than 40% of American adults now own cryptocurrency, up from 30% in 2023 [1].

With the rise of cryptocurrency adoption, this also underscores a new generation of consumers. Consumers who value privacy, speed, and convenience in their transactions. They’re looking for businesses that can offer these benefits, making companies that accept cryptocurrencies more attractive and forward-thinking.

Breaking Down Barriers

The long-standing barriers that have hindered global commerce are being broken down as cryptocurrency adoption continues parabolically. The decentralised nature of cryptocurrencies means that it operates beyond the confines of traditional banking systems and governmental oversight. This characteristic alone offers businesses a unique advantage: the ability to conduct transactions across borders with unprecedented ease.

The statistics speak volumes about the momentum behind the reach of cryptocurrencies. The cryptocurrency payment gateway market is poised for unprecedented growth. A recent study by Maximize Market Research reveals that this market, valued at USD $1.19 billion in 2022, is expected to surge to USD $4.12 billion by 2029, growing at a compound annual growth rate (CAGR) of 16.8% [2].

Streamlining Success

Cryptocurrencies offer the business world leverage to enhance operational efficiency and reduce costs. Traditional financial institutions act as intermediaries in transactions, which can incur fees that accumulate significantly over time. Cryptocurrencies cut out the middleman.

Another way of cost cutting, as stated by a study conducted by Botros Kfoury, is the underlying technology of cryptocurrencies which enhances security and transparency, potentially decreasing costs related to fraud and compliance [3].

The streamlining of business success through cryptocurrency is multi-faceted, encompassing efficiency and cost reduction. These advantages make a compelling case for the integration of blockchain technology into operations, positioning them as transformative tools in the modern business landscape.

Integrating AQX Pay: A Case for Competitive Edge

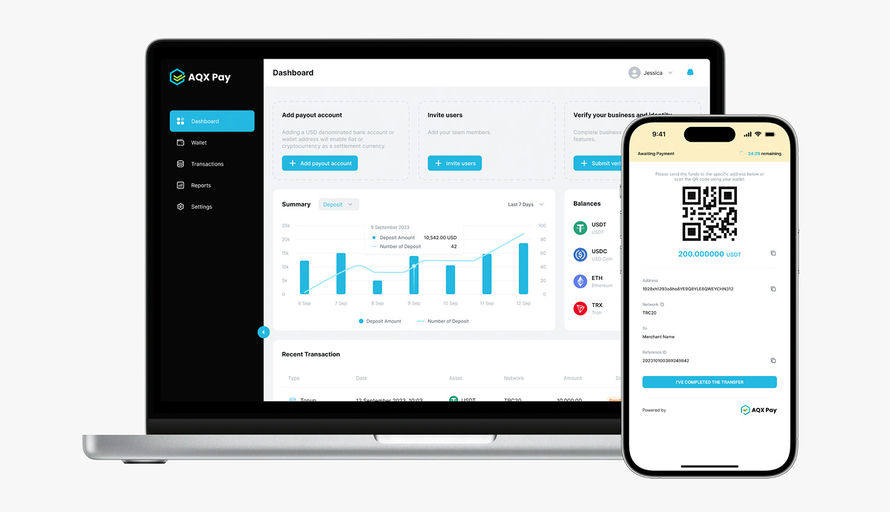

Introducing AQX Pay into your business operations transcends conventional benefits and is able to reshape your business’s market position. Here’s a closer look at how AQX Pay offers advantages to your business.

- Expanding Horizons: Embracing AQX Pay opens businesses to a broader, more inclusive customer base. Our fiat and digital asset payment gateway serves as a bridge, connecting your business with a diverse range of consumers who prefer digital currencies for transactions.

- Global Commerce, Redefined: The fact that AQX Pay offers both fiat and digital asset options equates to financial transactions not limited by geographic boundaries or currency differences, allowing businesses to operate on a global scale.

- Operational Excellence: The blockchain technology AQX Pay is built on ensures transactions are not only swift but secure. Our cold wallet storage elevates asset protection capabilities, hence minimising exposure to fraud.

Choosing AQX Pay allows businesses to be future-proofed for inevitable shifts in the markets. Here at Aquariux, we are partners with you, aligning with your business’s ambition to grow and stay ahead in the payment technology race. Find out more about our other solutions here.

References

[1] – Blackstone, T. (2024, January 30). 2024 Cryptocurrency Adoption and Sentiment Report. Security.org. https://www.security.org/digital-security/cryptocurrency-annual-consumer-report/

[2] – MAXIMIZE MARKET RESEARCH PRIVATE LIMITED. (n.d.). POS security market to reach USD 9.15 bn by 2029 at a CAGR of 11.28 percent – says maximize market research. Yahoo! Finance. https://finance.yahoo.com/news/pos-security-market-reach-usd-122200929.html

[3] – Kfoury, B. & Emart 77. (2021). The role of blockchain in reducing the cost of financial transactions in the retail industry. In WCNC-2021: Workshop on Computer Networks & Communications. https://ceur-ws.org/Vol-2889/PAPER_02.pdf