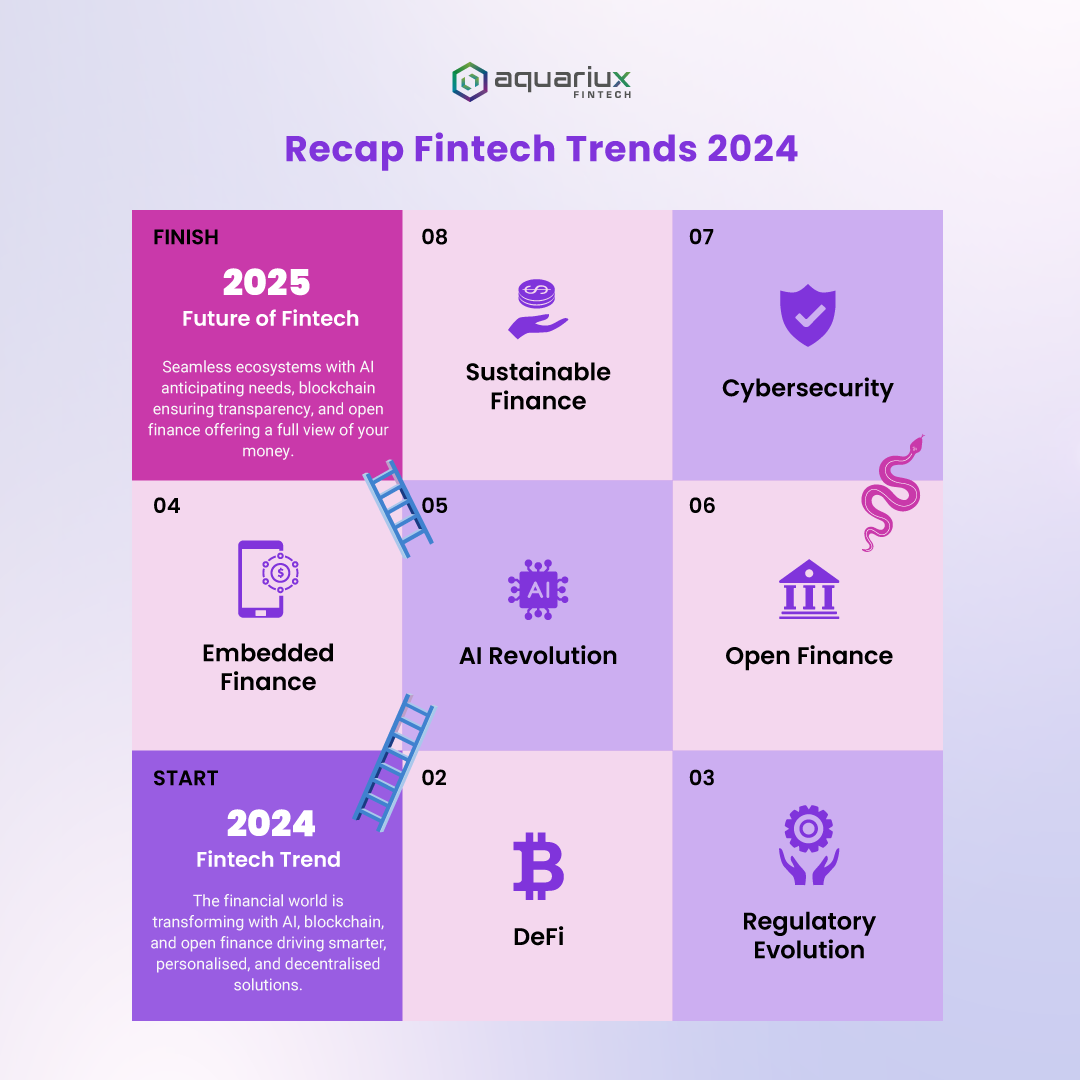

The financial technology landscape is undergoing a radical transformation. What was once a world of traditional banking is now a dynamic ecosystem of innovation, where technology is redefining how we interact with money. In our article “Q1 2024 Fintech Recap: A Dynamic Start to the Year”, financial technology has pushed far beyond incremental change, fundamentally transforming how we conceive of economic interaction.

From AI-powered insights to blockchain’s transparent ledgers, from digital currencies to green finance, we’re witnessing a technological revolution that goes far beyond mere innovation. These are powerful mechanisms reshaping how businesses and individuals engage with money.

Looking ahead to 2025, we’re on the brink of a financial transformation that promises to make money smarter, more accessible, and more aligned with real human needs than ever before.

The AI Revolution: Intelligent Financial Insights

Artificial Intelligence has moved beyond theoretical potential to become a pivotal force in financial services. No longer a distant dream, AI is now actively personalising financial experiences, offering insights that were once impossible to achieve. Companies like Robinhood are pioneering AI-driven financial advice platforms that go far beyond traditional algorithms.

These intelligent systems analyse vast amounts of personal financial data, learning individual spending patterns, investment preferences, and long-term financial goals. The result is a level of personalisation that feels almost intuitive. Machine learning models can now predict potential financial challenges, suggest optimisation strategies, and provide real-time guidance that adapts to changing personal circumstances.

The impact extends beyond individual advice. Financial institutions are leveraging AI for fraud detection, operational efficiency, and customer service optimisation. Chatbots powered by advanced natural language processing can now handle complex financial queries, while predictive analytics help banks and investment firms make more informed decisions.

Embedded Finance: Seamless Financial Integration

Embedded finance is breaking down the traditional barriers between financial services and everyday digital experiences. This revolutionary approach allows financial transactions to be seamlessly integrated into non-financial platforms, creating unprecedented convenience and accessibility.

Imagine booking a vacation and instantly accessing travel insurance, or shopping online and applying for a micro-loan with a single click. Companies like Astra Tech’s ‘Palm Pay’ are turning these scenarios into reality, transforming how consumers interact with financial services. The technology eliminates friction, making financial transactions as simple and intuitive as sending a message.

This trend is particularly powerful for small businesses and entrepreneurs. Embedded finance provides access to payment solutions, credit, and financial management tools directly within the platforms they already use. E-commerce platforms, social media networks, and mobile apps are becoming comprehensive financial ecosystems, democratising access to financial services.

Decentralised Finance: Reimagining Financial Systems

Blockchain technology and decentralised finance (DeFi) platforms are challenging traditional financial infrastructures, offering transparent, cost-effective, and secure alternatives. These technologies provide a level of financial accessibility and control that was previously unimaginable.

Companies like Flutterwave are at the forefront of this revolution, recognised for their innovative approaches to digital payment solutions. DeFi platforms eliminate intermediaries, reducing transaction costs and providing users with direct control over their financial assets. Smart contracts enable complex financial transactions to be executed automatically, with complete transparency and minimal risk.

The potential of blockchain extends beyond simple transactions. It offers solutions for cross-border payments, supply chain financing, and creating more inclusive financial systems. By removing geographical and institutional barriers, these technologies are creating a more accessible global financial network that empowers individuals and businesses alike.

Regulatory Evolution: Balancing Innovation and Protection

The regulatory landscape for fintech is becoming increasingly sophisticated, seeking to balance innovation with consumer protection. Governments and financial authorities are developing frameworks that encourage technological advancement while ensuring market stability and user safety.

The European Union’s proposed Financial Data Access (FIDA) regulation and the UK’s Data Protection and Digital Information Bill represent strategic approaches to managing the rapid fintech evolution. These regulations aim to enhance data sharing, promote competition, and protect consumer interests. Companies like Zilch are demonstrating how to navigate these complex regulatory environments successfully.

Open Finance: Comprehensive Financial Insights

Open finance is expanding the concept of open banking, creating a more holistic approach to financial data management. This trend allows for comprehensive data sharing across various financial products, providing users with unprecedented insights into their financial health.

Startups like 9fin are securing significant funding to develop platforms that integrate data from banking, investments, insurance, and other financial services. The result is a 360-degree view of personal and business finances, enabling more informed decision-making. Advanced analytics can identify optimisation opportunities, predict potential financial challenges, and provide personalised recommendations.

The open finance movement is about empowering consumers and businesses with comprehensive financial understanding. By breaking down data silos, these platforms are creating more transparent, efficient, and user-centric financial ecosystems.

Cybersecurity: Protecting Digital Financial Frontiers

As financial services become increasingly digital, cybersecurity has transformed from a technical requirement to a critical strategic imperative. Advanced technologies like Singapore’s SingPass face verification represent the cutting edge of user protection strategies.

Machine learning and artificial intelligence are now pivotal in developing adaptive security architectures. These technologies can predict, detect, and neutralise potential threats in real-time, analysing millions of data points to identify suspicious activities. Financial institutions are investing heavily in creating multi-layered security systems that protect both institutional and user assets.

Regulatory frameworks are evolving to support these efforts, establishing global standards for data protection and cybersecurity. The goal is to create a secure digital financial environment that can adapt to emerging threats while maintaining user trust and system integrity.

Sustainable Finance: Beyond Profit

The concept of financial success is expanding beyond mere monetary returns. Environmental, Social, and Governance (ESG) criteria are now central to investment strategies, reflecting a broader understanding of financial responsibility.

Innovative fintech platforms are developing tools that allow investors to align their financial goals with ethical considerations. Robo-advisors now offer ESG-focused portfolios, and blockchain technologies provide unprecedented transparency in tracking the social and environmental impact of investments.

Smart money is betting on sustainability. Major financial institutions are waking up to a powerful truth: companies that prioritise environmental and social responsibility are doing well. Businesses with robust ESG credentials are proving to become the blue-chip investments of the future, showing remarkable resilience and growth potential that traditional metrics can’t ignore.

Looking Towards 2025: A Dynamic Financial Frontier

The financial world is about to get a radical makeover. As we edge closer to 2025, a perfect storm of technologies – AI, blockchain, open finance, and decentralised systems – is cracking open the traditional financial landscape. What we are looking at is a complete reimagining of how money moves, how businesses operate, and how individuals interact with their financial lives. The old rules are being rewritten, and the pace of change is exciting.

For brokers and financial institutions navigating this shift, the future demands more. AQX Trader helps you stay ahead, providing a reliable, award winning trading platform for your end clients to enjoy.